XRP Price Prediction: Analyzing Bullish Patterns and Institutional Catalysts for 2025

#XRP

- Technical Consolidation: XRP trading below 20-day MA with bullish MACD suggests accumulation phase before potential breakout

- Institutional Catalysts: ETF filings, regulatory clarity, and cross-border payment adoption creating strong fundamental support

- Market Position: Surpassing traditional finance giants in market cap demonstrates crypto's growing dominance and XRP's leadership position

XRP Price Prediction

Technical Analysis: XRP Shows Consolidation Pattern Near Key Moving Average

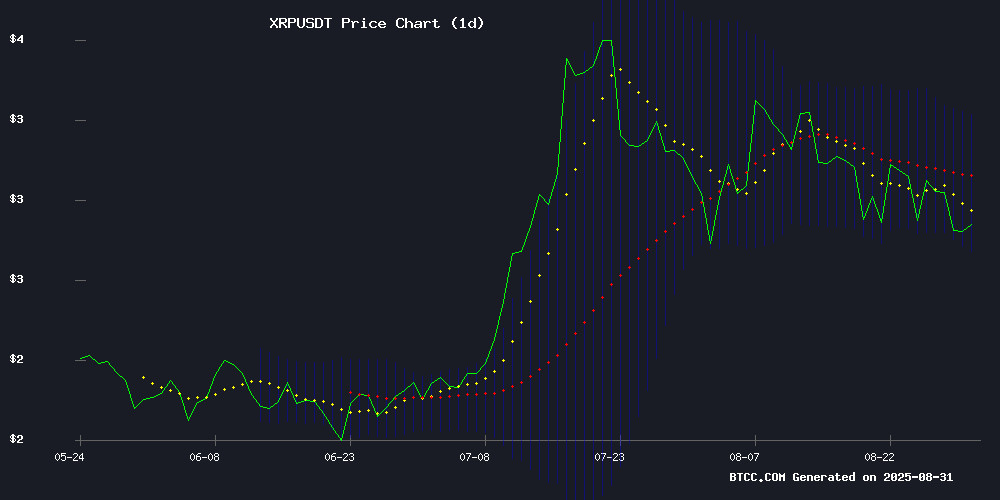

XRP is currently trading at $2.8153, slightly below its 20-day moving average of $3.0013, indicating potential consolidation. The MACD reading of 0.1520 above the signal line at 0.1191 suggests bullish momentum is building, though the histogram at 0.0329 shows modest strength. Bollinger Bands position the price between the upper band at $3.2682 and lower band at $2.7344, with the middle band aligning with the 20-day MA. According to BTCC financial analyst Sophia, 'XRP appears to be testing crucial support levels while maintaining overall bullish structure. The current positioning suggests accumulation phase before potential upward movement.'

Market Sentiment: Strong Institutional Tailwinds Support XRP Optimism

Market sentiment for XRP remains overwhelmingly positive as multiple catalysts converge. News of Amplify's XRP Option Income ETF filing for November launch, combined with emerging regulatory clarity and institutional adoption narratives, creates a favorable backdrop. The surpassing of BlackRock's market cap by XRP demonstrates crypto's growing dominance in traditional finance spaces. BTCC financial analyst Sophia notes, 'The combination of ETF developments, regulatory progress, and whale accumulation patterns suggests institutional confidence is building. These fundamental factors align with our technical outlook for potential upward momentum.'

Factors Influencing XRP's Price

Is an XRP Breakout on the Horizon?

XRP (XRP 0.45%) has exhibited significant volatility in 2025, with prices swinging between $3.56 and $1.79. Currently trading at $2.97, the cryptocurrency remains above the midpoint of its yearly range. This follows a staggering 421% gain over the past 52 weeks, fueled by bullish momentum in 2024.

Market sentiment is divided. Optimists point to catalysts like the upcoming RLUSD stablecoin, potential XRP ETF approvals, and favorable regulatory tailwinds under the TRUMP administration. The resolution of Ripple's SEC lawsuit has further cleared the path for growth.

Yet skeptics question whether XRP's $168 billion market cap aligns with fundamentals. RippleNet processed $713 million across 674,000 transactions recently—a respectable figure, but extrapolated annual volumes of $260 billion may not justify current valuations.

XRP Poised for Institutional Adoption as Regulatory Clarity Emerges

XRP stands at the threshold of a transformative phase as regulatory hurdles dissipate. Ripple's resolution of its SEC case with a $125 million fine has removed a critical overhang, while the GENIUS Act provides a legal framework for stablecoins. Federal Reserve Vice Chair Michelle Bowman's endorsement of blockchain applications further validates the sector.

The cryptocurrency has demonstrated remarkable resilience, surging 481% to $3.10 earlier this year before stabilizing at $2.94. Market participants anticipate significant catalysts in October, including potential spot ETF approvals and a decision on Ripple's banking license. Institutional interest is accelerating, evidenced by Thumzup Media's $50 million XRP allocation and planned expansion to $250 million.

GMO Miner has introduced an accessible XRP earning platform, eliminating traditional mining barriers. The service offers instant $15 signup bonuses, transparent fee structures, and daily payouts without equipment requirements.

XRP Price Prediction: Bullish Patterns and Whale Demand Amid Market Volatility

XRP trades at $2.82 with a $167.5 billion market cap, ranking third among cryptocurrencies. A 0.49% daily gain masks underlying tension: whales are offloading holdings while retail traders double down on bullish bets.

CryptoQuant data reveals sustained distribution by large holders throughout 2025, with brief pauses followed by accelerated selling. Meanwhile, retail sentiment remains fervently optimistic—Coinalyze shows funding rates at 0.0114, projected to rise to 0.0159, with $2.87B in open interest favoring long positions.

The ecosystem expands beyond speculation. Gemini and Ripple's new credit card offers 4% XRP cashback on fuel and EV charging, with select merchants providing up to 10% rewards. This utility push could counterbalance selling pressure if adoption accelerates.

XRP’s Market Cap Surpasses BlackRock as Crypto Gains Ground on Traditional Finance

XRP has achieved a significant milestone with its market capitalization exceeding $178.4 billion, surpassing asset management giant BlackRock. The digital asset now ranks among the world’s top 100 assets, reflecting growing institutional and retail confidence. Trading around $3 with a circulating supply of 5.95 billion, XRP’s previous high of $3.65 suggests renewed market Optimism as regulatory clouds dissipate.

Volatility remains inherent to crypto markets, prompting investors to seek stable alternatives. Platforms like SAVVY MINING, registered with the UK’s FCA, are capitalizing on this demand by offering accessible cloud mining solutions. The service requires no hardware expertise, lowering barriers to entry for passive income seekers.

Will This Crucial Support Finally Halt XRP’s Freefall as Ripple Whales Return?

Ripple's XRP has tumbled more than 20% from its mid-July peak, testing a critical support level at $2.76 that could dictate its next directional move. The token's recent plunge mirrors broader crypto market weakness, with failed recovery attempts highlighting persistent selling pressure.

Analysts point to whale accumulation as a potential bullish counterpoint to the technical breakdown. Ali Martinez emphasizes the $2.76 level as a make-or-break zone for maintaining XRP's bull market structure. The asset's daily close shows indecision, leaving traders watching for either consolidation or further downside.

XRP Emerges as a Top Contender for 2025's Crypto Spotlight

Ripple's XRP token, after enduring a prolonged slump from 2020 to early 2025 due to the SEC's lawsuit alleging unregistered securities sales, has finally cleared its legal hurdles. The resolution has paved the way for a remarkable resurgence, with XRP breaching the $3 mark in January 2025 for the first time in seven years and subsequently setting a new all-time high of $3.65 in July.

The potential approval of spot XRP ETFs by the SEC, under the leadership of pro-crypto chair Paul Atkins, could further catalyze growth. Atkins' vision to position the U.S. as a global crypto hub aligns with broader political support, including former President Trump's advocacy for domestic crypto companies. Ripple, as a U.S.-based firm, stands to benefit significantly from this regulatory and political tailwind.

Institutional adoption is already gaining traction, particularly in Japan, where banks are increasingly integrating Ripple's infrastructure. A similar trend could emerge in the U.S. as regulatory clarity improves, potentially driving XRP's price even higher.

XRP vs MAGACOIN FINANCE: Whale Activity and Market Trends Shape 2025 Crypto Landscape

As 2025 unfolds, the cryptocurrency market is witnessing a divergence between established assets like XRP and emerging contenders such as MAGACOIN FINANCE. Whale movements and institutional activity are driving unexpected trends, with XRP benefiting from regulatory clarity while MAGACOIN FINANCE gains traction through presale momentum.

XRP's legal saga reached a pivotal conclusion in August 2025, with a $125 million settlement cementing Judge Torres's ruling. Despite initial price volatility following institutional sell-offs, technical indicators suggest strong support at $2.90. Market infrastructure continues developing, highlighted by Gemini's XRP credit card offering 4% cashback and JP Morgan's bullish ETF inflow projections of $4.3–$8.4 billion.

Meanwhile, MAGACOIN FINANCE is capturing attention as a presale phenomenon, though detailed metrics remain scarce. The broader market shows whales accumulating 300 million XRP in August, while futures open interest surpassed $9 billion—signaling robust institutional participation.

Former US Senate Candidate Predicts Surge in XRP ETF Inflows Upon Approval

John E. Deaton, a cryptocurrency lawyer and former Senate candidate, anticipates significant capital inflows into XRP ETFs once the SEC grants approval. His prediction follows the growing number of filings, now totaling 15, including a recent application for a Monthly Option Income ETF by Amplify ETFs.

The proposed Amplify ETF diverges from traditional spot products by employing trading strategies to generate steady, capped monthly returns rather than relying on XRP's price appreciation. Despite mounting interest, the SEC continues to delay decisions, with key deadlines postponed until October.

Market observers note the regulatory hesitancy contrasts sharply with institutional demand. "15 is a lot," Deaton remarked, underscoring his conviction that adoption will exceed expectations. The coming months will test whether regulatory gates can hold back the building pressure for crypto investment vehicles.

Ripple Unveils Interactive Demo Showcasing XRP's Role in Cross-Border Payments

Ripple has launched an interactive demonstration of its payments platform, emphasizing XRP's function as a liquidity bridge between fiat and digital currencies. The platform enables instant conversions without additional fees, targeting inefficiencies in traditional systems like SWIFT, which are often slow and expensive.

The demo marks Ripple's aggressive push into enterprise payments, allowing institutions, corporations, and individuals to explore the system firsthand. This transparency aims to build trust among financial entities and multinationals reliant on efficient settlement networks.

As competition heats up in blockchain-based payments—with rivals like Circle and Stripe entering the fray—Ripple's open demonstration seeks to differentiate its technology. The company positions XRP and its upcoming RLUSD stablecoin as transformative tools for cross-border transactions.

Amplify Files for XRP Option Income ETF, Targeting November Launch

Amplify, a $12.6 billion asset manager, has submitted paperwork to the SEC for an XRP Option Income ETF. The fund plans to list on the Cboe BZX Exchange and begin trading in November. Unlike direct XRP purchases, the ETF will gain market exposure through holdings in XRP-tracking ETFs and option writing strategies designed to generate yield.

The fund's portfolio will allocate at least 80% to XRP-linked instruments, including shares of XRP ETFs and options on those shares. The remaining 20% will be held in US Treasuries, cash, or short-term equivalents. Synthetic exposure will be achieved through option contracts, such as pairing bought calls with sold puts at identical strikes and expirations, or purchasing in-the-money calls.

Analysts point to momentum in CME XRP futures and futures-linked ETFs as evidence of underlying demand. Nate Geraci of The ETF Store predicts approvals could unlock significant interest in XRP products, mirroring the inflows seen with Bitcoin futures-linked ETFs.

XRP Poised for Potential Triple-Digit Surge Amid Regulatory Developments

XRP emerges as a standout performer in the resurgent crypto market, with analysts projecting a possible 200% price appreciation before 2025 concludes. The token's current trajectory suggests a potential ascent toward the $5 threshold, fueled by growing institutional interest and pending regulatory clarity.

Regulatory negotiations with US authorities remain pivotal for XRP's adoption as a banking settlement solution. Positive developments could accelerate mainstream integration, while Ripple's expanding partnerships with Asian and European financial institutions demonstrate tangible utility beyond speculative trading.

Market dynamics show capital rotation from bitcoin into altcoins following BTC's recent all-time highs. This cyclical pattern historically benefits established tokens like XRP alongside emerging projects such as MAGACOIN FINANCE, which attracts risk-tolerant investors seeking exponential returns.

Is XRP a good investment?

Based on current technical indicators and market developments, XRP presents a compelling investment opportunity for 2025. The cryptocurrency is trading at $2.8153 with strong institutional catalysts including ETF filings, regulatory clarity, and growing adoption in cross-border payments. Technical analysis shows XRP consolidating near its 20-day moving average of $3.0013 with bullish MACD momentum building.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $2.8153 | Below 20-day MA, potential accumulation |

| 20-day MA | $3.0013 | Key resistance level to watch |

| MACD | 0.1520 (bullish above signal) | Positive momentum building |

| Bollinger Upper | $3.2682 | Potential upside target |

| Bollinger Lower | $2.7344 | Strong support level |

With multiple ETFs in the pipeline and regulatory developments providing clarity, XRP's fundamentals appear stronger than in previous cycles. However, investors should maintain appropriate position sizing and risk management given cryptocurrency volatility.